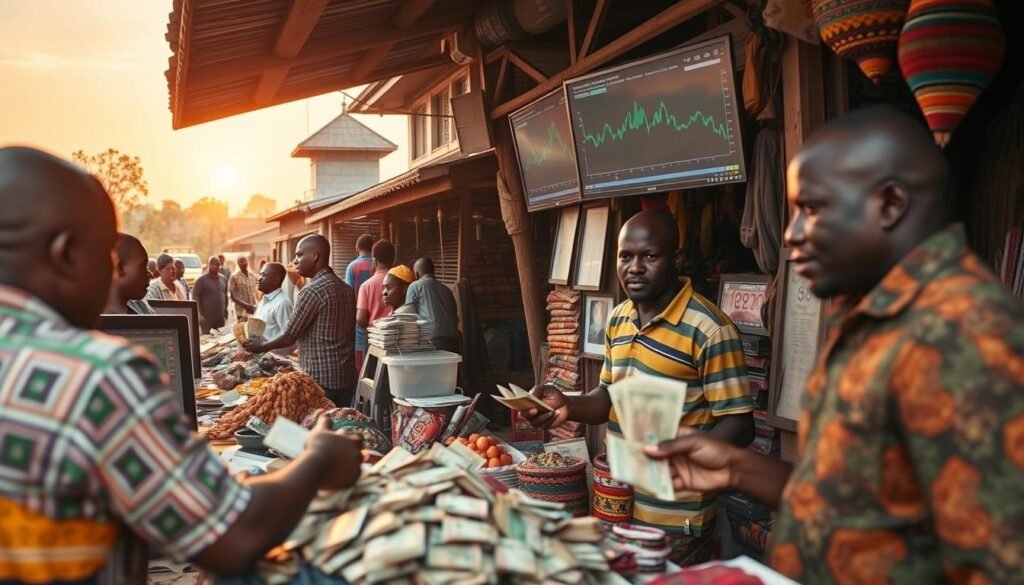

Top Forex Brokers: Find the Best Trading Platforms

Finding the right forex broker is key to your success in currency trading. This guide will help you find the best trading platforms for your needs. It’s perfect for both seasoned traders and newcomers to forex.

We’ll cover everything from what forex brokers do to their regulation and security. You’ll learn about their trading platforms and costs. By the end, you’ll know how to pick the best forex broker for you.

Key Takeaways

- Discover the key features and services offered by top forex brokers.

- Understand the importance of regulated and secure forex brokers for your trading activities.

- Explore the trading platforms and tools that provide a seamless forex trading experience.

- Learn about the various account types, leverage, and cost structures offered by forex brokers.

- Identify the top forex brokers that cater to your specific trading needs and preferences.

What Are Forex Brokers?

Forex brokers help people buy and sell foreign currencies, known as forex trading. They offer platforms, tools, and services for traders to guess the market’s changes. Knowing how forex brokers work is key for traders to succeed in the market.

Understanding Forex Trading

Forex trading is about exchanging one currency for another to make money. Traders buy and sell currency pairs like EUR/USD or GBP/JPY. They aim to profit from market changes. This market is always open, 24/7, five days a week.

Role of Forex Brokers

Forex brokers are essential in the trading world. They give traders the tools to enter the market. Their main tasks include:

- Providing a platform for traders to place orders

- Offering market analysis and educational resources

- Executing trades and managing accounts

- Ensuring trading is safe and follows rules

- Helping traders with support and advice

Knowing about forex brokers helps traders find the right partner for their currency trading goals.

Evaluating Top Forex Brokers

Choosing the best forex brokers is crucial for your trading success. You need to look at several important factors. This will help you find a forex broker that fits your investment goals and trading style. Let’s dive into the key criteria for comparing top forex broker reviews.

Regulation and Security

When picking a forex broker, their regulatory status is key. Look for brokers with licenses from top financial bodies like the Financial Conduct Authority (FCA) or the National Futures Association (NFA). This means your money is safe and the broker follows strict rules.

Trading Platforms and Tools

The trading platform is vital for your trading experience. Check if the platform is easy to use, has the tools you need, and works well on different devices. Choose a broker that offers various platforms to fit your trading style.

Account Types and Leverage

Forex brokers offer different account types with varying requirements and conditions. Think about your risk level and experience when picking an account. Also, consider the leverage offered, as it affects your potential gains and losses.

| Broker | Regulation | Trading Platforms | Leverage |

|---|---|---|---|

| Broker A | FCA, ASIC | MetaTrader 4, cTrader | 1:30 |

| Broker B | CySEC, FINRA | Web Trader, Mobile App | 1:200 |

| Broker C | FSCA, DFSA | MetaTrader 5, Proprietary | 1:100 |

By carefully looking at these factors, you can choose the best forex brokers for your needs. They should offer a safe and efficient way to reach your financial goals.

Regulation and Security

Forex trading needs strong regulation and security. It’s key to pick a licensed online forex broker. This protects your money and makes sure you follow the rules.

Importance of Regulated Brokers

Regulated forex brokers face strict checks from bodies like the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. These groups make sure traders are safe, by keeping their money separate and following strict rules.

Choosing a regulated broker has many benefits:

- Client fund protection: Your money is kept safe, separate from the broker’s.

- Following industry standards: Brokers must trade fairly and openly.

- Dispute resolution: There’s a way to solve problems between you and the broker.

- Trust and credibility: Regulated brokers are seen as reliable, which is important in forex regulation and online forex brokers.

With a regulated broker, you can trade knowing your money and actions are protected. This is thanks to strong oversight and security.

Trading Platforms and Tools

The forex trading experience starts with the trading platform. It’s like a gateway to the forex markets. When looking at top forex trading platforms, consider several key features. These can improve your trading journey a lot.

Features like easy-to-use interfaces, powerful charting tools, and fast order execution are important. The right platform can greatly impact your success in forex trading.

Features to Look for

When checking out online forex brokers, watch for these important features:

- Intuitive and customizable user interface for easy navigation

- Comprehensive charting tools with technical indicators and analysis capabilities

- Efficient order execution, ensuring your trades are processed quickly and accurately

- Mobile accessibility, allowing you to trade on the go from your smartphone or tablet

- Advanced order types, such as stop-loss and take-profit, to manage your risk effectively

- Robust educational resources and tutorials to help you grow as a forex trader

By focusing on these key features, you can find a forex trading platform that fits your trading style and goals. This will help you confidently navigate the dynamic forex market.

“The right trading platform can be the difference between a successful forex trading journey and a frustrating one.”

Account Types and Leverage

Choosing a forex broker means looking at their account types and leverage. Brokers offer different accounts for all kinds of traders. This includes beginners and experienced traders, each with their own style and risk level.

Let’s dive into the main forex account types and why leverage is key in currency trading.

Forex Account Types

- Mini Accounts: These accounts need a small deposit, making them great for new traders. They have smaller trade sizes, helping to manage risk better.

- Standard Accounts: These are the most common. They offer bigger trade sizes and more flexibility for seasoned traders. The deposit needed is higher than mini accounts.

- Cent Accounts: Perfect for beginners or those with little money. They use tiny trade sizes, letting traders practice with little risk.

- Islamic Accounts: For traders following Sharia law, these accounts don’t charge interest. They offer swap-free trading.

Forex Leverage

Leverage is a powerful tool in forex, letting traders control big positions with small capital. Brokers offer leverage from 1:1 to 1:500 or more. While it can increase profits, it also increases losses. Traders must manage their risk well.

| Leverage Ratio | Minimum Deposit | Potential Profit/Loss |

|---|---|---|

| 1:100 | $1,000 | $10,000 |

| 1:200 | $500 | $10,000 |

| 1:500 | $200 | $10,000 |

When picking a forex broker, think about the account types and leverage they offer. Choose the right account and use leverage wisely. This can improve your trading experience and success in forex.

Spreads and Commissions

Understanding the costs in the forex market is key. This includes spreads and commissions from brokers. These fees can greatly affect your trading profits. It’s important to know how to compare and manage them well.

Forex Spreads Explained

The forex spread is the difference between the buy and sell prices of a currency pair. Brokers make money from this spread. Spreads vary among brokers, so it’s crucial to compare them to save on costs.

Broker Commissions

Some brokers also charge a commission per trade. These can be a percentage of the trade value or a fixed amount per lot. Comparing these commissions helps you find the best deal for your trading strategy.

When picking a forex broker, look at both spreads and commissions. A broker with tight spreads might have higher commissions. On the other hand, a broker with lower commissions might have wider spreads. Finding the right balance helps you cut down on forex costs and increase profits.

| Broker | Average Forex Spreads (EUR/USD) | Commissions |

|---|---|---|

| Broker A | 0.6 pips | $4 per lot |

| Broker B | 0.8 pips | $2 per lot |

| Broker C | 1.0 pips | No commissions |

By understanding and comparing forex spreads and commissions, you can make a smart choice. Pick the trading platform that fits your financial goals and trading style.

Top Forex Brokers

Forex trading can seem overwhelming, but the right broker makes it easier. We’ve looked at the top forex brokers to find the best for you. Each broker has special features to meet different trader needs.

Our analysis helps both new and experienced traders. We cover everything from safety and regulation to trading tools and learning resources. Our goal is to help you choose the best broker for your needs.

| Broker | Regulation | Platforms | Spreads | Leverage |

|---|---|---|---|---|

| XYZ Forex | FCA, CySEC | MT4, MT5, Web Trader | from 0.1 pips | up to 1:500 |

| ABC International | ASIC, VFSC | Proprietary, cTrader | from 0.3 pips | up to 1:400 |

| Gamma Capital | FSA, FSCA | MT4, Web Trader | from 0.2 pips | up to 1:300 |

We’ll explore what makes each broker special. This will help you pick the right one for your trading goals. By the end, you’ll know which best forex brokers can help you succeed.

“Finding the right forex broker is crucial for success in the market. Our in-depth evaluation ensures you can confidently choose the one that best suits your trading needs.”

Customer Support and Education

Entering the forex market can feel overwhelming, especially for beginners. Top forex brokers understand this and offer great support and education. They provide the help and tools you need to make smart trading choices and reach your financial goals.

Trader Assistance and Resources

For forex trading, having reliable support and learning materials is key. The best brokers offer many ways to help, including:

- Live chat and email support, with experts ready to help quickly

- Loads of educational content, like videos, webinars, and articles, on various trading topics

- Interactive tools, such as simulators and demo accounts, for practicing without risk

- Personal advice from account managers, tailored to your trading needs

Using these resources, you can learn more about the forex market. You’ll improve your trading skills and make better, more confident choices.

“The level of customer support and educational offerings provided by a broker can greatly impact your overall trading experience and long-term success.”

Whether you’re experienced or new to trading, the best forex brokers focus on your growth. They ensure you have the support and tools to succeed in the fast-paced world of currency trading.

Deposit and Withdrawal Methods

When picking a forex broker, it’s key to think about how easy it is to fund your account. Forex brokers offer many ways to deposit and withdraw money. This lets traders choose a method that fits their needs best.

The best online forex brokers have a variety of payment options. These include:

- Credit and debit cards (Visa, Mastercard, etc.)

- Electronic wallets (e.g., PayPal, Skrill, Neteller)

- Bank wire transfers

- Local banking options (e.g., ACH, iDEAL, Giropay)

- Cryptocurrencies (e.g., Bitcoin, Ethereum)

Each forex broker has different payment methods and times. Some may have minimums or fees. Always check the broker’s rules and compare to find the best fit for you.

Looking at the deposit and withdrawal options helps you choose a broker. This way, you can focus on your trading without hassle.

“The ability to easily fund and access your trading account is a critical factor in choosing the right forex broker.”

Mobile Trading

In today’s fast-paced financial world, trading forex on the go is a big advantage. Top online forex brokers know how important mobile trading is. They offer easy-to-use platforms and apps that let traders manage their money from anywhere.

Unlock the Power of Mobile Forex Trading

Top forex trading platforms now have strong mobile apps. These apps let traders watch market trends, make trades, and keep up with their investments while moving around. They are easy to use, with simple designs, advanced charts, and updates in real-time.

Whether you’re on your way to work, traveling, or away from your computer, these apps keep you connected. They offer push alerts, live quotes, and quick order placing. This lets you grab chances and avoid risks quickly.

“Mobile trading has revolutionized the way I manage my forex portfolio. The convenience and responsiveness of these apps have been a game-changer for my trading experience.” – Jane Doe, Experienced Forex Trader

As financial markets keep changing, being able to trade anywhere is key. By choosing a top online forex broker with great mobile trading, you can lead the market. You can take advantage of changes anytime, anywhere.

Promotions and Bonuses

In the world of forex trading, many forex brokers offer promotions and bonuses. These can attract new clients and reward existing ones. They can help you make the most of your trading and possibly increase your earnings. Let’s explore the bonuses and promotions available in the forex market.

Welcome Bonuses

Many forex brokers give welcome bonuses to new traders. These bonuses can be a percentage of your first deposit or a fixed amount. They help you start your forex trading journey with a boost.

Deposit Bonuses

Deposit bonuses are common among forex brokers. They are a percentage of the money you put into your trading account. This bonus adds to your trading capital.

Loyalty Programs

Some forex brokers have loyalty programs for their active and long-term clients. These programs offer special benefits. You might get lower trading fees, personalized support, or higher leverage forex account types.

Refer-a-Friend Bonuses

Many forex brokers reward clients for referring friends and family. By referring others, you could get bonuses. These bonuses can add funds to your account or offer other rewards.

It’s important to read the terms and conditions of any promotions or bonuses. This way, you know what you need to do and what you can expect. It helps you use these opportunities wisely.

“Promotions and bonuses can be a valuable tool in your forex trading arsenal, but it’s important to understand the fine print and use them strategically.”

Choosing the Right Broker

Choosing the right forex broker is crucial for your trading success. It affects your experience and results. Look at several key factors to pick the right broker for your goals and risk level.

Factors to Consider

To find the best forex brokers for you, remember these points:

- Regulation and Security: Choose a forex broker with a good reputation. Look for regulation from bodies like the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC). This keeps your money safe and ensures the broker follows strict rules.

- Trading Platforms and Tools: Check the trading platform’s ease of use and features. Make sure it fits your trading style and needs.

- Account Types and Leverage: Look at the forex broker’s account choices and leverage. Pick an account that suits your investment and risk level.

- Spreads and Commissions: Know the forex broker’s pricing, including spreads and commissions. This helps you find the best rates.

- Customer Support and Education: Evaluate the forex broker’s customer service and educational tools. Good support and learning resources are key for your growth.

By thinking about these points, you can pick the best forex broker for you. This choice will help you start a successful trading journey.

“Choosing the right forex broker is like finding the perfect partner – it takes time, research, and a keen eye for detail to ensure a harmonious and profitable relationship.”

Conclusion

In this guide, you’ve learned key insights to find top forex brokers and the best trading platforms. You now know how to choose based on important factors like regulation and security. Also, trading platforms, account types, and more.

The top forex brokers in this guide offer many features for traders of all levels. Whether you’re new or experienced in forex trading, this guide helps you pick a broker that fits your needs.

As you explore the forex market, always do your research and stay updated on regulations. Don’t forget to ask for help or learn more. This way, you’ll be ready to succeed in the exciting world of forex trading.

FAQ

What are forex brokers?

Forex brokers help people buy and sell foreign currencies. They offer a place to trade and tools for speculating on currency changes.

Why is regulation and security important when choosing a forex broker?

Regulation and security are key when picking a forex broker. A licensed broker protects your money and follows industry rules.

What features should I look for in a forex trading platform?

Look for a user-friendly platform with advanced tools. It should also have reliable order execution and mobile access for on-the-go trading.

What types of forex trading accounts are available?

Brokers offer different accounts with varying requirements and options. Choose one that fits your trading style and risk level.

How do I understand the costs associated with forex trading?

Forex trading has costs like spreads and commissions. Compare these across brokers to find the best value.

What kind of customer support and educational resources do top forex brokers provide?

Good brokers offer support and learning materials. They help new traders and guide them through their journey.

What deposit and withdrawal methods are available with leading forex brokers?

Leading brokers offer flexible funding options. They accept various methods like bank transfers and electronic wallets.

What mobile trading capabilities do top forex brokers offer?

Top brokers provide mobile trading platforms. This lets you trade from anywhere, at any time.

What types of promotions and bonuses do forex brokers offer?

Brokers offer promotions and bonuses to attract and reward traders. These can include welcome bonuses and trading rewards.

What are the key factors to consider when choosing the right forex broker?

Consider regulation, platforms, account types, and costs. Also, look at customer support and educational resources. This helps find the right broker for you.